The greatest luxury of money is not having to worry about it. And yet we are worried. We are so attached to metal and paper or the less touchable abstract numbers appearing when we log in to our bank account – even if we never spend them.

And it limits us. It limits us in our ability to follow what’s real and be a force for necessary action. Rather than having to be subjected to our fears and anxiety around scarcity.

So how can we feel more comfortable in these tricky situations where we feel like we have to ask for something that we are not supposed to be so attached to?

Let’s structure our answer (as usually) into two more digestable parts:

One is to get a grasp of the subconscious processes that inevitably and in some cases uncontrollably dominate our action.

Another one is to dive into a self-test of: Where is my bottleneck? In what specific ways do I procrastinate, self-sabotage and undermine my own ability to get what I want? And most importantly: What is MY way of attracting what I deserve?

The key measurement of your money mindset: The Financial Thermostat.

The financial thermostat is a beautiful measurement of our will and ability to leave our comfort zone to attract more money or to just gracefully sit there and receive it. Most of us know the concept of a thermostat from the heating system at home: When the temperature is too low, the thermostat raises it back to its desired level. When it’s too high, the thermostat drops it to where it’s comfortable to us again.

Similarly with money. Our money mindset functions just like an inner thermostat where we will automatically gravitate towards a level of money that we feel comfortable with. The key word here is: Comfort. When our income/ hourly salary/ revenues (whatever your measurement) drops below a certain level, we will work hard, can’t sleep at night, will do everything to get it back up. But once we reach above and beyond, we magically stop leaving our comfort zone: We stop working so hard, we stop asking for a raise, we feel just ok where we are. The average person – in case of winning the lottery and suddenly becoming a millionaire – probably would just feel great. Many would take a year off. If the same happened to Bill Gates, he’d probably panic seeing his fortune being “decreased” to one million only – and start working frenetically.

One might wonder how it is even possible that smart people procrastinate or that – when we have a chance to ask for a raise or to invoice a really high amount, we postpone or self-sabotage in other ways? Like… not having the phone call, not sending the invoice, not signing the contract.

So here comes the brave hypothesis and that is: We all have a level of income that represents comfort to us. Comfort in terms of: We can live more or less happily with it. And it does not yet produce resistance in us, like: “too much money makes me arrogant”, “If I earn loads, it’s missing in someone else’s pocket” etc.. Like a scaringly stable “money equilibrium” to which we always return.

What feels like us being run by some inner lunatic really is far more common and explainable through ordinary psychology than we think it is.

And if we lean into this hypothesis we begin to grasp how this is precisely why some of us – in terms of wealth creation – will hit into an income glass ceiling. A ceiling above which they will struggle to earn. And for those who roll their eyes when yet another coach tells them that “Mindset is really it”: this is how it impacts us, namely that the moment we feel comfort we stop doing the wise and the hard action.

So, welcome to the table, doubters, let’s get on with it!

Is your financial thermostat high enough?

… is hence the question we’ve got to ask.

But before that: What determines our thermostat? Why do some people have a higher one than others?

The answer is both obvious as well as annoyingly simple: Childhood stuff. Parental influence. And that is so because almost all our stories have been created between our 3 and 7 years of age – where our parents simply were our most present storytellers.

When exploring our money thermostat the following three pillars make sense to look at.

- What temperature is your thermostat currently at? i.e. what level of income/ salary/ revenues/ fortune feels “right” for you?

- When are you in the money-flow? i.e. what situations can you think of where you find it easy (or: easier than others) to attract money? What feelings and what inner self-talk are these situations accompanied by?

- When do you experience resistance? Which real or imagined situations come up in front of your inner eye that give you feelings uncomfortable enough to stop the action you know you could or should pursue? What is the story behind those feelings and where have you picked that up?

Now, we suggest to spend no more than 15min on taking an inventory of your inner storyboard. It is useful to distinguish between the radio programme that your brain constantly blasts at you and reality. But it makes little sense to purposelessly indulge into it. After all the mindless consumption of our own inner stories either throws us into a state of self-pity or arrogance. In any case we loose our ability to look at what actually happens to us fresh and neutrally.

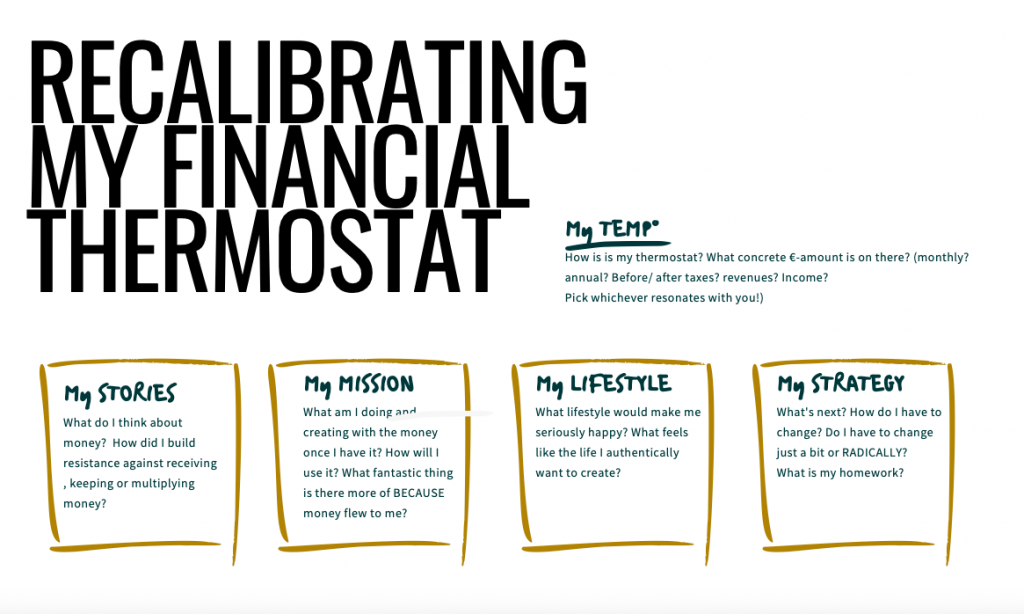

So how do we recalibrate our inner story board? How do we consciously pick a more inspired temperature on our money thermostat?

From experience (aka completely unproven but otherwise pretty nice) we suggest to adjust the following temperature controllers to your liking:

My stories

- What do I think about money? How did I build resistance against receiving , keeping or multiplying money?

WHY THIS QUESTION? The reason why we ask this is obvious – or at least it should be if you read anything of what is written above.

My mission

- What am I doing and creating with the money once I have it? How will I use it? What fantastic thing is there more of BECAUSE money flew to me?

WHY THIS QUESTION? We ask this because thinking about the GOOD things we create once we receive money helps us to lower our resistance and our sense of guilt of owning “more” than others.

- And if you still have high moral doubts as to why having lots of money at your disposal think about: How would you LOVE “rich people” to behave? How would you love them to spend their days? What kind of leadership would you love to see from them? And start living like that!

My lifestyle

- What lifestyle would make me seriously happy? What feels like the life I authentically want to create?

WHY THIS QUESTION? Simply. If doing what you do won’t make you feel like you are on the winning side of life, you will always feel deeply unsatisfied, in complaints and like a victim of your circumstances. If that sounds like your past behaviour it is time to think about: What are indicators for you that you are happy? Just so that you know when you have reached it!

My strategy

- What’s next? How do I have to change? Do I have to change just a bit or RADICALLY? What is my homework?

WHY THIS QUESTION? Almost all coaching will only work, if certain action follows. There are very few topics where “soul-searching alone” will do the job for you. Hence, yes, we do invite you to take an educated and adult look at your answers and come up with a solid (!) strategy that actually has a chance of working. This is the point where you take responsibility. It is nice to sit in our chairs and complain that life hasn’t presented a trigger-free life where all our vain expectations are met without us having to leave our comfort zone. But.. [finishing this phrase probably isn’t necessary as we can all think of numerous objections].

My temperature

- Having worked on all other temperature controllers, let’s figure it out for you: How is is my thermostat? What concrete €-amount is on there? (monthly? annual? Before/ after taxes? revenues? Income? Pick whichever resonates with you!)

When you are done. Lean into the silence. In any workshop, lecture or teaching unit there is always that empty silence when the explanation of a task is complete.

Now let’s use that vacuum to be present, to be open to new and better stories.

Because after all:

A sure sign of inspired action is enthusiasm. Curiosity. And courage. Real courage. Not manufactured. And very little fear.

#just_dare

Would you like to receive this Coaching exercise as a workbook for self-study?

Put your email address below to receive this workbook and many other self-coaching inspirations to your inbox: